In this post I want to highlight a few stocks out of the hundreds in my all-time high stock screen to a page (available in the 'Stock Screen Results' tab at the top of the blog).

I selected 14 stocks that would be candidates for long-term trend following based on a combination of:

- Momentum: the stocks are on the all-time high list, so they are in uptrends by any definition.

- Fundamentals: high Piotroski and Altman scores, indicating that the companies are well run.

- Growth: above average quarterly EPS growth and sales growth

Most of the names - including Fossil Inc (FOSL) - are spread across the Basic Materials, Consumer Goods, and Technology sectors, providing some opportunity for diversification.

| Fundamentals, Growth, and Institutional Support | |||||||||||

| Symbol | Sector | F score | Z score | Market Cap | EPS Q/Q | Sales Q/Q | Div. | Pay out | Inst Own | Inst Trans | Target Price |

| APKT | Technology | 7 | 45.4 | 3.43B | 169% | 56% | % | 0% | 78% | 0% | 44.8 |

| CRR | Basic Materials | 7 | 19.3 | 2.29B | 40% | 29% | 1% | % | 92% | 1% | 91.6 |

| FFIV | Technology | 7 | 20.8 | 11.26B | 67% | 45% | % | % | 94% | -3% | 120.7 |

| FOSL | Consumer Goods | 9 | 11.6 | 4.70B | 92% | 37% | % | 0% | 79% | -4% | 76.9 |

| GNTX | Consumer Goods | 8 | 23.1 | 3.77B | 40% | 33% | 2% | 47% | 81% | -2% | 24.1 |

| HMSY | Services | 8 | 25.3 | 1.80B | 28% | 35% | % | 0% | 98% | 1% | 62.6 |

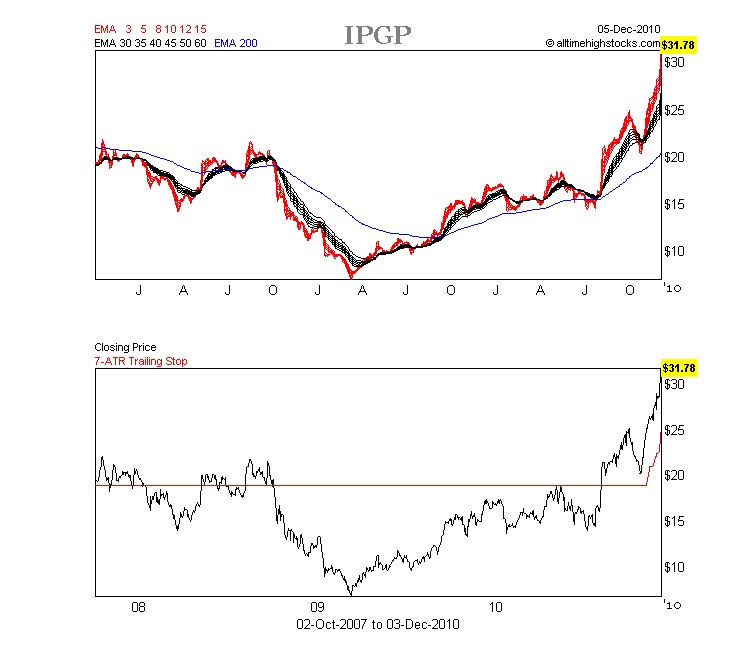

| IPGP | Technology | 7 | 11.9 | 1.49B | 474% | 74% | % | 0% | 47% | 8% | 29.0 |

| NEOG | Healthcare | 7 | 19.6 | 862.60M | 29% | 33% | % | 0% | 69% | -4% | 35.0 |

| OPEN | Services | 7 | 33.6 | 1.66B | 325% | 44% | % | 0% | 82% | 3% | 73.2 |

| PII | Consumer Goods | 8 | 5.9 | 2.59B | 47% | 33% | 2% | 39% | 76% | 3% | 80.1 |

| RES | Basic Materials | 7 | 9.3 | 3.03B | 539% | 129% | 1% | 21% | 27% | -1% | 27.8 |

| SHOO | Consumer Goods | 8 | 11.8 | 1.28B | 26% | 31% | % | 0% | 92% | 6% | 50.8 |

| WLT | Basic Materials | 7 | 6.1 | 5.85B | 466% | 67% | 0% | 7% | 95% | 1% | 108.3 |

| XEC | Basic Materials | 8 | 4.2 | 7.35B | 256% | 52% | 0% | 5% | 89% | 0% | 83.6 |

| A high Piotroski F-score indicates financial strength, and a low Altman Z-score predicts bankruptcy Data are from GrahamInvestor.com, Yahoo Finance, and Finviz.com | |||||||||||

Most of the stocks show insider selling, which is somewhat concerning (or perhaps contrarian bullish?).

IPG Photonics Corporation (Nasdaq: IPGP) has the highest rate of institutional accumulation and has decisively pushed above its IPO price after struggling for nearly 3 years.

…the big money [is] not in the individual fluctuations but in the main movements — that is, not in reading the tape, but in sizing up the entire market and its trend. -Jesse Livermore

|

Related Posts

- Stock screen results - US and Canada

- Why many Investors Lose Money

- Watchlists are useless without Action

- Trade with Focus

- Trend-trading Potash Corp 2006-2008

- On Setting Stops

No comments:

Post a Comment