Back in February I reviewed some of Jesse Livermore's sage advice on staying with the trend in a bull market (This is a Bull Market you know). At the time I highlighted three pieces of evidence, none of which are still true. Prior to that I had mentioned that I was watching the financials as they were on the verge of a Weinstein stage two breakout. That obviously didn't follow through, and they broke down instead. All this is to say, we are not in a bull market for stocks anymore. I'm not saying anything new here, but it is for the sake of the archive I suppose.

Fortunately, trend-following is designed so the trader doesn't need to forecast the end of a bull market, nor the beginning of the next one. Trailing stops and regularly watching the market of stocks are the tools of the trade. As Alexander Elder said:

"To make money trading, you do not need to forecast the future. You have to extract information from the market and find out whether bulls or bears are in control. You need to measure the strength of the dominant market group and decide how likely the current trend is to continue."Here are several charts from the past bull market that had nice runs. The up-trends are gone. The stop-losses were triggered. The stocks charts are broken. It will take a long time for these stocks to set up again, if they ever do. In the meantime, this quote from upsidetrader seems appropriate (time-frame notwithstanding):

"Stocks are like taxis, another one will come along in five minutes"

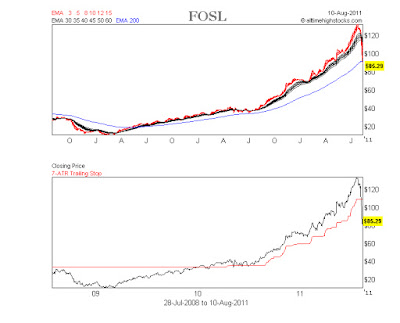

Fossil (NASDAQ: FOSL): a consistent guest in the all-time high list. Also one of the few stocks with a Piotroski score of 9.

Acme Packet (NASDAQ: APKT): what can I say, a beauty. It reminds me of Potash Corp back in 2008.

Edwards Lifesciences (NASDAQ: EW): a really smooth trend and low correlation with the S&P500.

Computer Modeling Group (TSX: CMG.TO): an obscure Canadian stock that just stair-stepped higher. It's still trying to hang in there, but the chart has lost its shine.

Having said all that about stocks, there is still a raging bull market in physical Gold (not as much with the miners). It too may end someday, but for now the trend continues higher.

I also learned to stay out of bear markets unless my stocks remain in their boxes or advance. -Nicolas Darvas

|

Related Posts

- Priority List

- Fossil - FOSL

- Edwards Lifesciences - EW

- Computer Modelling Group - CMG.TO

- Van Tharp on Stalking Your Next Trade

- Trend-trading Potash Corp 2006-2008

No comments:

Post a Comment